Managing your money doesn’t have to be stressful or overwhelming. It’s not about giving up everything you love or skipping your morning coffee; it’s about learning smart strategies that help you save money while still getting the things you want. Whether it’s snagging a cute new outfit, treating yourself to a self-care day, or finally saving up for that dream vacation, there are ways to make it happen without breaking the bank. The key? Be intentional and purposeful about how you spend, save, and splurge. "Girl math" can be practical, too! If you’re ready to get financially savvy while still living your best life, here are some strategies that can help you balance saving and spending with ease.

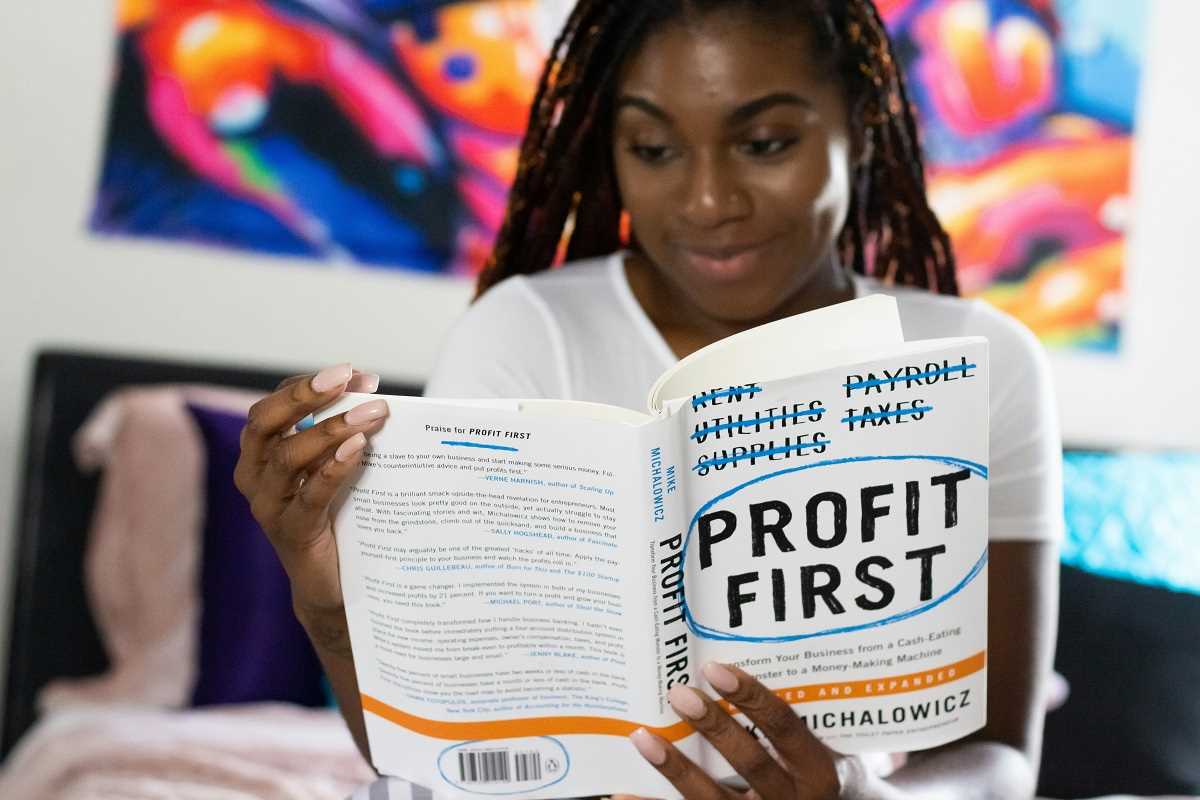

Master the Art of Budgeting

Budgeting is like the foundation of any smart money strategy. Don’t panic—it’s not about spreadsheets and crazy math. It’s simply about knowing how much money you have, where it’s going, and how you can direct it to match your goals.

The easiest way to start budgeting is to break your money into three basic categories: needs, wants, and savings. Needs are things like rent, groceries, and bills. Wants are fun extras like shopping or eating out. And savings are for your future goals, whether that’s an emergency fund, new car, or bigger purchases.

A popular method is the 50/30/20 rule, where 50% of your income goes to needs, 30% to wants, and 20% to savings. Of course, you can adjust these percentages to suit your life. Use budgeting apps like Mint or YNAB (You Need A Budget) to track everything and see where your money is going at a glance. This way, you can avoid overspending and still set a little aside for the things that matter to you.

Become a Smart Shopper

Shopping smart doesn’t mean giving up your love for cute outfits, luxury skincare, or home decor. It’s all about finding ways to get what you want for less. Start by keeping an eye out for sales, clearance events, and seasonal discounts. Many stores and online retailers offer huge savings at the end of each season, so you can snag high-quality pieces without overspending.

Another trick? Don’t underestimate the power of coupons and promo codes. Apps like Honey and RetailMeNot automatically scan for discounts while you shop online. You can also sign up for store loyalty programs for exclusive deals and rewards.

Thrifting is another great option. Vintage finds from thrift stores or apps like Poshmark and ThredUp can help you score unique fashion pieces at a fraction of the price. Plus, it’s sustainable, which means you’re saving money and the planet. Double win!

Make the Most of Cashback and Rewards Apps

Imagine getting paid to shop—that’s exactly what cashback and rewards apps do for you. Apps like Rakuten, Ibotta, and Fetch Rewards make it easy to earn cashback or points every time you make purchases at participating retailers. Over time, those perks add up, and you can put that money toward future purchases or save it for something special.

For credit card users, choosing a card that offers cashback or rewards on everyday purchases like groceries or gas can boost your savings. Just be sure to pay your balance on time each month to avoid interest fees. The key here is to use these tools wisely. Don’t buy things just to earn rewards; stick to what you actually need or genuinely want.

DIY Your Way to Savings

Think of how much money you could save if you made something yourself instead of buying it. Whether it’s your beauty routine, home decor, or gifts, DIY is an amazing way to save while still getting exactly what you want.

Instead of shelling out for salon prices, try doing your own nails at home with affordable gel nail kits or press-ons. Pinterest and TikTok are packed with beauty and skincare DIY tutorials, showing how to create face masks, scrubs, and more with simple ingredients you already have in your kitchen.

If you love decorating your space, you can tackle fun DIY projects like making wall art, upcycling thrift store furniture, or creating personalized decor pieces. Not only does it save you some serious money, but it can also give your space a one-of-a-kind vibe.

Got a birthday or holiday coming up? Ditch the expensive store-bought gifts and try making a thoughtful custom gift instead. Whether it’s a handwritten letter, a homemade candle, or a delicious baked treat, these gifts are budget-friendly and super meaningful.

Prioritize and Plan for the Big Stuff

While small purchases can add up, saving for those big-ticket items can be more intimidating. However, with smart planning, it’s totally doable. Start by listing your big goals. Maybe it’s a vacation, a new bag, or upgrading your tech. Whatever it is, create a specific savings plan for it.

Divide the cost of your goal by how many months you want to save for it. For example, if you want to save $600 for a weekend getaway in six months, that’s $100 a month. By breaking it down into smaller chunks, the goal feels more manageable.

You can also make it a habit to create a “splurge fund.” Any extra cash you get from side gigs, cash rewards, or refunds can go into this fund, so you’ll have money reserved for the things you’ve been dreaming of.

Know When to Say No

No matter how tempting it is, not every purchase is worth it. One of the best money strategies you can adopt is simply saying “no” to things that don’t bring joy or add value. This doesn’t mean being hard on yourself; it means being thoughtful about where your money goes.

Before making a purchase, give yourself a cooling-off period. Add the item to your cart or wish list, but wait 24-48 hours before checking out. Often, you’ll realize that impulse “must-have” wasn’t that important after all.

Instead of spending on things that offer fleeting happiness, direct that money toward what truly matters to you, whether that’s experiences, self-investment, or long-term goals.

Lean on Your Community

Sometimes, saving money is simply about working with the resources you already have. Don’t be afraid to ask friends or family for help, advice, or even to borrow something. Need an outfit for a wedding? Instead of buying new, swap dresses with a friend. Looking for new furniture? Check if anyone is decluttering before heading to the store.

Facebook Marketplace, Buy Nothing Groups, and community swap events are goldmines for finding gently used (or sometimes free) items. The key is staying resourceful and being open to opportunities.

Make Saving a Fun Challenge

Saving money doesn’t have to be boring. Turn it into a fun challenge by gamifying your progress. Create mini-goals, like staying under your weekly spending limit, and reward yourself with something small and meaningful when you succeed.

You can also try creative ideas like a “no-spend week” where you only use what you already have or save every $5 bill you receive. Challenges like these make saving feel like a game, not a chore, and help you stay motivated.

.jpg)